Surf the natural wave

Business development • A strong trend is passing like a great wave through the sea of consumers. Ever more consumers want "natural" foods, or at least foods that don't contain "unnatural" ingredients. The hysteria around E-numbers is a source of worry. But have you considered how your company can make use of this trend? How can you surf the wave of greater consumer awareness about manufacturing methods and ingredients? In this article I will give you a few hints to get started.

More and more consumers reject foods with an excessive amount of additives. There is instead a strong demand for “natural” foods.

The trend can be said to have started in 2008, when the journalist Mats-Eric Nilsson, in his book The secret chef, “revealed” that benzine is used in the manufacturing of margarine. The trend is today driven by bloggers, youtubers and other influencers with many followers. And traditional media enhance the effect by publishing reports on the “cheating” methods of the food industry.

Even the great must adapt

A current example of how influencers drive the trend and traditional media enhance it, is the anti-prize Årets matbluff [the fake food of the year].

The prize is awarded by the consumers’ association Äkta vara [the real stuff], founded by Mats-Eric Nilsson – the journalist who set it all about.

In the beginning of the year Årets matbluff was awarded to Lätta, after a good 30,000 participants had placed their vote. The motivation was:

The classic light margarine Lätta claims to contain rapeseed oil and buttermilk in several places on its packaging: ‘Made with Swedish rapeseed and tasty buttermilk’. It is also decorated with rapeseed flowers. They enhance the fact that it’s made in Sweden. Only in the fine print on the back you can read that the main ingredient, apart from water, is the far more long-hauled, and for both environmental and health reasons, disputed palm oil.

The prize was widely covered in Swedish media; Sveriges television, DN, SvD, GP, Sydsvenskan, Aftonbladet, Expressen, Metro, DI and in a range of other traditional media.

Årets Matbluff has been awarded every year for the last ten years. And the effect? Two thirds of the finalists have either changed their recipes or have simply been taken off the market.

Consumers take ingredients seriously

That such a large part of the finalists in Årets matbluff have been reformulated or taken off the market shows the strength of the tsunami-like wave of consumers exerting their power. Further proof can be found in the many studies that have been undertaken.

According to market research company YouGov’s annual studie of Nordic consumers’ perception of food, climate and health, half of them worry about the ingredients in foods.

Another study studie, commissioned by the association Äkta vara, shows that 93 per cent of consumers have rejected foods based on them containing too many additives.

A studie performed by Sifo, the Swedish marketing and opinion research company, shows that 62 per cent of Swedes found that the amount of additives in foods was rather or quite important when buying food. The only thing considered more important was the sugar content.

Natural – a relative concept

Natural or not, it’s in the eye of the beholder. What one person considers natural; another may consider unnatural. Just take for instance sweetening with stevia.

Stevia is a plant. With few exceptions the plant itself is not allowed to be used as sweetening. But, the substances that are responsible for the sweet taste – steviol glycosides – are allowed to be extracted and used. Does that make steviol glycosides natural?

Yes, in the sense that they exist in nature and are not created synthetically.

But no, if you ask Livsmedelsverket, the Swedish Food Agency. Why? Well, because they are extracted, which is technically a process.

But what do the consumers think? Some say heck no, as steviol glycosides are extracted in a process. But most probably agree that steviol glycosides are as natural as regular sugar – but not as unhealthy.

The fact is that regular sugar is also extracted. In a process that is very similar to how steviol glycosides are extracted. So why then, is sugar considered natural? That is a question for another article…

This is the natural trend

You can’t get away from the fact that food and drink go through some kind of process as they are produced. Consumers are not so naïve that they believe anything else. But more and more want to avoid such products that they consider artificial. They prefer products from a natural source. That is what the natural trend means.

Be proactive. Not reactive.

The natural trend caught on ten years ago. There are still no signs that it will fade. The demand for the natural is most likely here to stay. It is a reality that your company has to relate to. Resistance is futile.

I am assuming that your company has already made some adjustments. Perhaps replaced one ingredient with another from a more natural source. Or you write citric acid instead of acidity regulator, or use common names instead of E-numbers.

That’s all well and hopefully enough at the moment. But there’s no rest for the wicked. Natural is a megatrend. Under its umbrella a whole range of other fast trends come and go. Trends that your company needs to adjust to. That is why you need to keep up to date on what influencers say and what consumers demand.

But why stop there? Why only be reactive?

The natural trend gives you an opportunity to be proactive: to strengthen your brand, take a stand, create differentiation and motivate a premium price.

Strengthen your brand

A brand is so much more than a name, a logo or another “mark” that is possible to register. It is most of all the promise that consumers think the brand represents.

Take for example Paulúns. If you ask consumers who buy their products what they associate Paulún with, they will probably say that the food is healthy but tasty, made with natural ingredients and completely without additives and sugar. The description they give is Paulúns brand.

Paulún is a strong brand, as most consumers who choose their products have a clear and mostly coherent view of what it stands for (I assume).

But is Paulún a known brand? I would think not particularly. If you ask the average person to name all the brands they associate with cereals, müsli, crisp bread, biscuits, pasta, soups etc. there probably won’t be many who’ll say Paulún.

In other words, strong and known is not the same thing. So, which is more important?

Both are of course important. But it’s no use to have a known brand if it’s not a strong brand. In that case it’s better to be less known but strong among those who do know it. Like Paulúns.

The point of a strong brand is spelled profitability. Brand oriented companies are twice as profitable compared to those who don’t prioritise their brands. This is proven by the brand researcher Frans Melin in his research project Brand Orientation Index.

The natural trend gives you the possibility to strengthen your brands by taking a verbal stand for the natural, against the artificial, synthetic and unnatural. And to take an active stand in showing you mean what you say by using ingredients from a natural source.

Take a position

The position a brand has is the space it occupies in the minds of consumers, relative to competitors’ brands. With targeted and tenacious market communication a brand can become top of mind with consumers.

Pandy was started in 2015 by students who found a gap in the fitness market. They describe their product as a “low sugar and high protein snack for the consumer that seek guilt-free indulgence”. With a consequent and persistent message they have taken this stand with the fitness consumers. Others could try to take the same stand, but Pandy has a head start which makes it difficult for competitors to take over.

The demand for natural foods creates new position where “ingredients from natural sources” is combined with other appreciated qualities. Find such an unfilled position, and claim it with your brand. It will serve as a protection against competitors.

Create differentiation

Differentiation is one of Michael Porter’s three general strategies. It means doing something different than everybody else, and earning the customers who appreciate, above all, what you do differently.

Coca-Cola did something different whey they in 2014 introduced Coca-Cola Life in Sweden. Instead of using just sugar, as they do in Classic, or to replace it with artificial sweeteners, as in Zero and Light, they replaced a part of the sugar with a sweetener from a natural source. The company’s Swedish CEO said at the time that the reason for this was to “meet changed lifestyle trends”.

By differentiating the brand Coca-Cola Life as a “coke drink with less calories with a sweetness from natural sources”, Coca-Cola tried to grab a position for the brand.

Coca-Cola’s introduction of Life in Sweden was a brave attempt at riding the lifestyle trend for foods from a natural source. The drink is no longer sold in Sweden but it still serves as an example of how you can catch on in the natural trend through differentiation

Motivate a premium price

The foods your company manufacture probably have equivalent products made by other distributors. If your products are not differentiated clearly enough compared to other producers’ products, if you haven’t taken a defendable stand, and don’t have a strong brand, then the likelihood is great that you are stuck in the low price trap. Not an enviable situation.

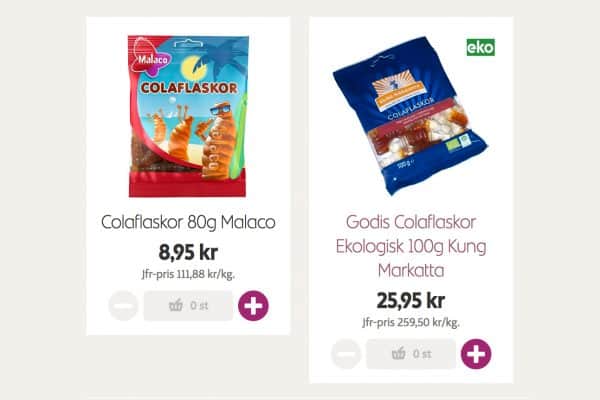

What is enviable is the position Kung Markatta has on the market. They get twice the price for their chewy coke bottle sweets with natural aromas, compared to what Malaco gets for their coke bottle sweets with (unnatural?) aromas.

So what is the conclusion? Consumers are prepared to pay a premium price for what is considered natural.

Of course ingredients from a natural source cost more than equivalent ingredients that are produced synthetically or through “unnatural” processes. But as consumers are willing to pay considerably more for food from natural sources the margins are still higher, despite more expensive ingredients. Not a bad deal, in other words.

But of course, it takes a strong brand, known for its position which means a differentiation with ingredients from natural sources.

Please, share this article if you liked it.

[et_social_share]